STRABAG share

Find out more about the STRABAG share, the current share price, the shareholder structure, analyst ratings and our dividend policy.

With a market capitalisation of around € 9.5 billion at the end of the half-year 2025, STRABAG is one of the largest listed companies in Austria. The company has been listed on the Prime Market of the Vienna Stock Exchange since 2007. We are proud of our solid financial basis and our long-term vision, which puts people, the planet and progress at the centre and therefore generates added value. Our reliable dividend policy reflects our commitment to regularly share this added value with our shareholders.

- Number: 118,221,979 bearer shares and three registered shares

- Listing: Vienna Stock Exchange (STR), Bloomberg (STR:AV), Reuters (STRV.VI)

- Market segment: prime market

- ISIN: AT0000STR1

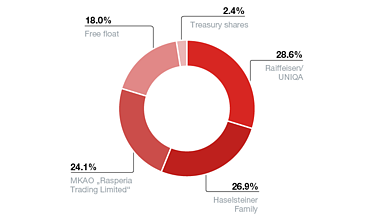

Shareholder structure

This is the shareholder structure as of February 2026:

- Haselsteiner Family: 26.9%

- Raiffeisen/UNIQA: 28.6%

- MKAO "Rasperia Trading Limited": 24.1%

- Free float: 18.0%

- Treasury shares: 2.4%

There is a syndicate agreement running until 31 December 2032 between the core shareholders, including the Haselsteiner Familien-Privatstiftung, Dr. Hans Peter Haselsteiner, Raiffeisen-HOLDING NIEDEROSTERREICH-WIEN registrierte Genossenschaft mit beschränkter Haftung and Group company, and Uniqa Insurance Group AG and Group companies. This essentially regulates the following:

- Rights to nominate Supervisory Board members

- Coordination of voting

- Restrictions on the transfer of shares

Until 31 December 2022, a syndicate agreement had existed between the aforementioned Austrian core shareholders and MKAO “Rasperia Trading Limited”. The former syndicate agreement still results in a right of first refusal against MKAO “Rasperia Trading Limited”. However, this right of first refusal may only be exercised following the award of appropriate licences in compliance with European Union sanctions regulations.

The share capital of STRABAG SE amounts to € 118,221,982, divided into 118,221,979 bearer shares and three registered shares. Registered share 1 is held by Haselsteiner Familien-Privatstiftung, registered share 2 is held by Rasperia. The owners of the registered shares bearing the numbers 1 and 2 are entitled to delegate one member each to the Supervisory Board. At present, however, the rights associated with registered share 2 have been suspended due to the sanctions affecting Rasperia.

Disposal of the registered shares bearing the numbers 1 and 2 requires approval by the Supervisory Board.

Total number of voting rights

Total number of voting rights (2 April 2024)

Total number of voting rights (21 March 2024)

Analyst coverage and recommendations

STRABAG is currently monitored and evaluated by five financial analysts, four of whom have issued a buy recommendation (Buy/Accumulate/Outperform) and one a hold recommendation.

| Institution | Analyst | Phone number | E mail | Recommendation |

|---|---|---|---|---|

| Erste Group | Michael Marschallinger | +43 0 50100 0 | michael.marschallinger@erstegroup.com | Buy |

| Kepler Cheuvreux | n/a | n/a | n/a | Hold |

| LBBW | Jens Münstermann | +49 711 1273 0 | jens.muenstermann@lbbw.de | Buy |

| ODDO BHF Austria | Markus Remis | +43 1 253 121 0 | markus.remis@oddo-bhf.com | Buy |

| Raiffeisen Research | Gregor Koppensteiner | +43 1 71707 7533 | gregor.koppensteiner@rbinternational.com | Buy |

Analyst consensus

The following consensus figures contain the consolidated estimates of our analysts as at 2 March 2026. The average target price is € 108.60.

2025e |

2026e |

2027e |

|

|---|---|---|---|

| Revenue in € million |

18,823 |

20,411 |

21,580 |

| Clean EBIT incl. associates in € million |

1,242 |

1,158 |

1,243 |

| Reported net income in € million |

858 |

800 |

852 |

| Dividend per share in € |

2.72 |

2.80 |

2.90 |

| Reported earnings per share in € |

7.44 |

6.93 |

7.38 |

| P/E | 11.2 |

13.6 |

12.8 |

The recommendations are compiled and updated by STRABAG for information purposes. They are not to be understood as investment advice and are based on estimates and forecasts by various analysts regarding the company’s revenues, earnings and business developments. STRABAG SE cannot guarantee that this list is complete.