Investment Case

Investment Case

The name expresses the opportunity to invest in four attractive growth markets with just one security – the STRABAG share: mobility infrastructure, energy and water infrastructure, high-tech facilities, and the decarbonisation of the building stock. These markets align perfectly with our Strategy 2030 priorities, allowing us to leverage our strengths in a targeted way, with the clear objective of delivering sustainable growth and creating long-term value for our investors.

Competitive advantage

Value proposition

-

Strong market positions through critical sizeWith an annual output volume of € 19 billion, STRABAG is the largest construction technology group in Central Eastern Europe. In its European core markets, STRABAG is either the market leader or ranks among the top four. The company’s operations are primarily focused in Europe, Australia & the Middle East, and the Americas.

- Market leader in CEE

- € 19.2 bn output volume | 2024

- € 25.4 bn order backlog | 31 Dec. 2024

- 86,000 Employees | 2024

-

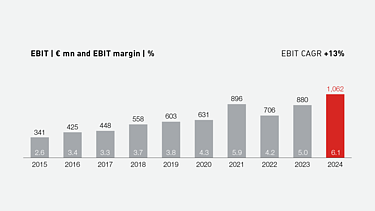

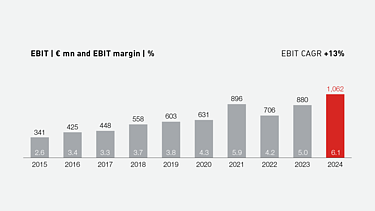

Resilience through 4-fold diversificationSTRABAG is in a position to realise projects of almost all sizes and in all segments for both the public and private sectors world-wide. This broad positioning helps to balance out economic fluctuations, which has enabled the EBIT margin to more than double in the last decade.

- Full coverage of the construction value chain

- Active in 50 countries globally

- From microprojects to megaprojects

- Serving public and private sector clients

-

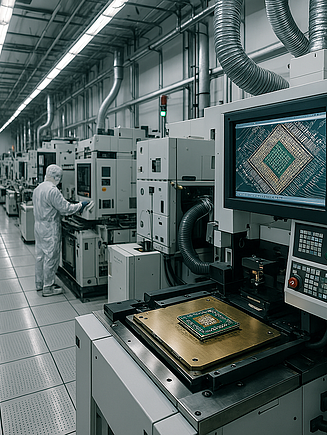

Innovation and sustainability through technology leadershipBy leveraging technology, STRABAG is shaping the future of construction. The focus is on standardisation, digitalisation and automation. This makes construction processes more efficient while delivering innovative and sustainable solutions – all with a clear goal: to design, build and operate in a climate-neutral way by 2040.

- > 250 innovation projects

- > 400 sustainability projects

- Solid ESG ratings from CDP, Sustainalytics, EcoVadis and ISS ESG

-

Stability through financial strength & effective risk managementSTRABAG’s financial strength allows it to act on business opportunities in a flexible manner. Maintaining this competitive advantage is therefore a strategic priority. A corporate-wide risk management system ensures uniform and binding standards across geographic borders and – supported by artificial intelligence – reduces the risk of loss-making projects.

- > 30% equity ratio | 2015-2024

- € 2.9 bn net cash position | 31 Dec. 2024

- BBB+ Investment Grade Rating by S&P

Value creation

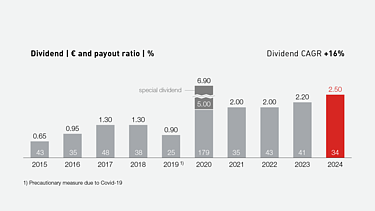

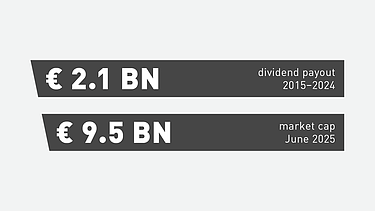

Reliable dividend through sustained earnings growth

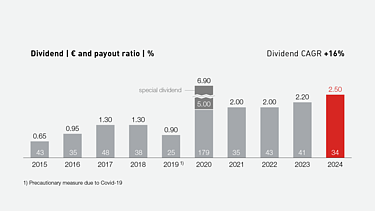

- STRABAG plans to increase its EBIT margin to 6% by 2030 as a strong basis for a reliable dividend.

- With a dividend payout ratio of 30% to 50% of net income after minorities, the STRABAG share is among those titles with the highest dividend yield in the ATX Prime Market.

- The core shareholders are committed to long-term engagement and sustainable value creation.